Cedi Ranked World’s Worst-Performing Currency In Third Quarter

Cedi Ranked World’s Worst-Performing Currency – Discover the causes of the Ghana cedi’s sharp depreciation, its impact on imports and inflation, and the economic outlook for 2025. Learn why it’s ranked as the world’s worst-performing currency.

Ghana’s Cedi Plummets: Understanding the World’s Worst-Performing Currency

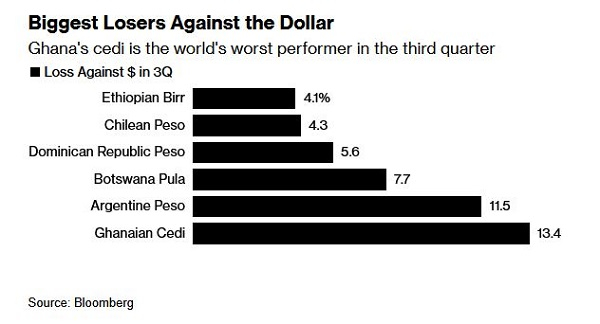

According to a recent Bloomberg report, Ghana’s national currency, the cedi, has earned the unfortunate title of the world’s worst-performing currency this quarter. This sharp decline, linked to soaring demand for U.S. dollars, a limited foreign exchange supply, and a heavy national reliance on imports, marks a dramatic reversal from its strong performance earlier in the year. Consequently, this depreciation is sending ripples through the entire Ghanaian economy.

From Rebound to Reversal: A Quarter of Contrasts

The cedi was once hailed for its impressive recovery. It rallied by a remarkable 50% last quarter. This was driven by stronger gold prices. Widespread market optimism also helped. However, this positive trend has now completely reversed. Between July and September, the cedi weakened significantly. It fell by 13% against the U.S. dollar.

A primary catalyst is the Bank of Ghana’s inability. It cannot meet the full demand for foreign currency. For instance, commercial banks submitted dollar requests. They reportedly received only about half of their bids. “The central bank is now trying to meet demand,” clarified Hamza Adam. He is Head of Market Risk at UMB Bank Ltd.

Seasonal Pressures and Structural Challenges

Furthermore, Ghana’s economic structure significantly amplifies this problem. The nation’s economy is heavily reliant on imported essentials like food, fuel, and machinery. Typically, demand for dollars intensifies even more ahead of the Christmas season as traders and businesses aggressively stock up on supplies. This seasonal spike places additional strain on the country’s foreign exchange reserves.

Despite international reserves reaching a three-year high of $11.1 billion by June, the Bank of Ghana has adopted a cautious stance. Officials have stated that their role is to ensure currency fluctuations remain orderly. Their goal is to let the market reflect economic fundamentals without abruptly eroding hard-won investor confidence.

The Real-World Impact on Ghanaians

For ordinary citizens, however, this economic theory translates into tangible hardship. The cedi’s depreciation has already triggered a rise in market prices. Almost immediately, importers have passed on their higher costs to consumers. This action intensifies inflationary pressures, directly affecting street vendors, transport operators, and households that depend on imported goods.

Looking Ahead: A Challenging Road to Recovery

Ultimately, the immediate future remains challenging. The cedi traded at 11.95 per U.S. dollar in Accra on Wednesday. Analysts now predict that unless substantial inflows from key exports like cocoa and gold increase, or support from international partners materializes, the intense pressure on the local currency will likely persist through the end of the year. Therefore, the path to stabilization requires both internal fiscal discipline and favorable external economic conditions.

Cedi Ranked World’s Worst-Performing Currency